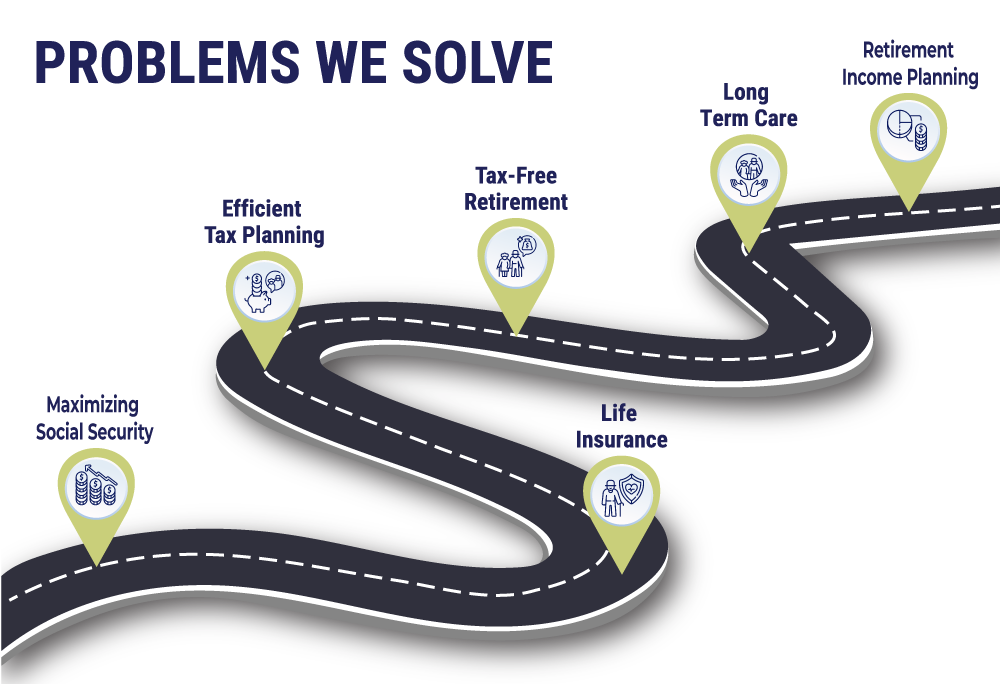

PROBLEMS WE SOLVE

Learn More About Tax Planning

Learn More About Tax Free Retirement

Learn More About Long Term Care

Learn More About Life Insurance

Learn More About Maximizing Social Security

Learn More About Retiremaent Income Planning

Retirement Options

When the economy can change on a dime, how can anyone really plan their retirement? This oft–asked question has caused many to throw up their hands entirely. Of course, financial advisors at a retirement firm see the question very differently. They know that there are ways to reasonably secure a person’s future, and this is true regardless of what unexpected events the world has in store for them.

Understanding Your Retirement Options

By the time a person has amassed a certain degree of wealth, they need to start thinking about whether it will be enough for all of the things they want to do. They may even want to ask if it will be enough for goals they might not even have right now, such as financing a loved one’s future education plans.

At e Hill Financial Group Inc., people in the Colorado Springs, Colo., and Ft. Lauderdale, Fla., areas, and in states across the country, can learn more about how they can maximize what they have now so they can be insulated from even the worst downturns. Whether it’s a personal illness or a global recession, the idea is to cushion your wealth as much as possible. Eugene W. Hill in Florida and Eldrick L. Hill in Colorado are both available to give their clients the guidance they need to successfully get to the next phase in their life.

You’ve been managing your portfolio for your entire life, but a financial advisor will prompt youto do things a little differently. If it ever starts to feel like too much is on your plate, an experienced advisor can break it down for you in just a few simple steps:

1. Decide what you can save every month and figure out how you want to structure your monthly income.

2. Let your advisor manage a portion of your portfolio for aggressive growth.

3. Sit back and relax!

When you’ve worked your whole life, it just makes sense to enjoy a few luxuries as a reward. At e Hill Financial, you’ll not just learn how to do it, but you can be entirely confident in the plan they help you design.

Retirement Income Planning

Retirement income planning is a way for retirees to replace their paychecks, so there’s as little of a financial transition as possible when it comes time to leave their jobs. Exactly how the planning is mapped out will be different for every individual. If you’re asking how much do I need to retire, you might think it’s about saving up a certain amount.

For instance, $1 million will net you roughly between $40,000 and $50,000 per year, which can be enough to live on for many. However, a financial advisor will look at the matter a little more strategically. For them, it’s about diversifying your revenue streams so there’s not questions about where the money is coming from or how much of it there will be.

How to Plan Your Retirement Income

At e Hill Financial Group Inc., a boutique retirement firm with locations in Fort Lauderdale, Fla., and Colorado Springs, Colo., you’ll meet a professional staff that’s ready to help. Both Eugene Hill in South Florida and Eldrick Hill in Colorado help clients decide on the right paths for them, whether that means purchasing more property, adding new stocks, or trying for a tax–free retirement.

Most people don’t realize how many options are out there if they want to secure their wealth by the time they reach retirement age. Income can come from pensions, Social Security, or rental checks. It can even come from a part–time job.

However you choose your retirement income, you can count on experienced advisors to lay out all the advantages of each decision. They’re also not shy about telling you the potential downsides. For instance, owning property can be one of the soundest ways to bring in passive income — but not everyone will want to be a landlord. The most important thing to remember is that you’re getting all of your options now so you can make smarter decisions later.

Efficient Tax Planning

There’s a lot to know when it comes to filing your taxes, and this is true no matter where you live in the U.S. While some states are certainly more forgiving than others, the general idea is that what you pay comes down to which federal, state, and local laws apply to your portfolio. Unfortunately, most people are unaware of how those rules impact their bottom line. Efficient tax planning is a strategy that can give you more options by the time the tax deadlines roll around.

How Does Tax Planning Work?

The goal of this financial concept is to employ a financial professional who knows more than just your take–home pay and major deductions. Even more than a CPA, the right financial professional has more context to every line item in every form. At e Hill Financial Group Inc., Eugene W. Hill in Ft. Lauderdale, Fla., and Eldrick Hill in Colorado Springs, Colo., can offer guidance that takes into account your investment style, personal preferences, and lifestyle aspirations.

When you hire a financial advisor, you get to speak to someone who knows the big picture behind your goals. For instance, maybe you’re structuring your portfolio so it can fund first–class travel by the time you retire or pay for a descendant’s higher education. From deferrals and retirement account rollovers to trusts and charitable giving, it’s likely you have more options than you realize.

Working at a boutique retirement firm like e Hill Financial Group doesn’t just mean

personalized service. Here, you’ll find two experienced professionals who can make smart. decisions that ultimately support the rest of your retirement plans. This isn’t about getting out of paying your share to the US government, only about not leaving them a tip when there’s no need. Far too many people overpay, regardless of whether they file every quarter or every year. Most of the time, it’s because they don’t realize there are other avenues available. The Hills can

give you all the information you need to not make the same mistake.

Life Insurance

Life insurance can be an undeniably difficult topic to delve into. While some people take it as nothing more than a practical matter, others might choose their policy based on price or even sheer convenience. They do so partially because they’re busy, but also because it’s not always easy to study the many terms and conditions of each plan. If you’re looking for a plan that will actually cover your loved ones instead of containing hidden clauses that attempt to skimp on responsibility, a financial advisor may be able to help.

Deciding on a Life Insurance Policy

You’re likely already familiar with the two major categories of life insurance: term and perm. Term life insurance, also known as the inexpensive type of insurance, is designed to last up until a certain point. Should the policy not be used by then, it expires and the beneficiaries are no longer entitled to financial compensation.

People who choose this type of life insurance typically do so when they have children. For instance, a mother might set up her financial policy so it expires the day her youngest turns 21 or a grandfather might set up his policy so it expires the day his youngest grandchild graduates from college. There’s no denying that this affordable option is the right choice for many, but you may also want to look into the potential benefits of permanent life insurance. A financial advisor can tell you that, in addition to the policy remaining in place until the policyholder passes away, there’s also a potential savings component that could be of use to you — particularly if you hit an unexpected bump in the road during your retirement years.

If you live in Ft. Lauderdale, Fla., or Colorado Springs, Colo., e Hill Financial Group Inc. is there to help you get a handle on it all. When there are numerous carriers and plans available, sometimes it helps to have someone who can help you sort it all out for you.

Maximizing Social Security

Social Security has been an unreliable safety net for some time now. While it was never going to make the recipient rich, it may have once been a way for beneficiaries to get the money they needed to cover a variety of expenses during retirement.

Today, no financial advisor would tell their clients to use it as their sole source of income. What they would say is that Social Security can be used as the base for the rest of your retirement income. It just helps if you know how to maximize how much you receive.

How to Maximize Social Security

Maximizing Social Security comes down to knowing a program that has gone through multiple iterations since it was first introduced in the 1930s. If you’re wondering how exactly you do that, you should know that it’s no easy task. The number of restrictions and loopholes is enough to make anyone’s head spin.

When you work with a financial advisor, you can talk to someone who knows how your career is viewed by the Social Security Administration. From your job title to how much you’ve paid over the years, there are key details that affect your monthly benefit check. At e Hill Financial Group Inc., with locations in Colorado Springs and Ft. Lauderdale, you’ll meet a staff that can tell you more about what to expect.

The most important thing you can know about this famous system is that there are nuances to be found once you know where to look. The average check may be $2,500, but the discrepancies between each person can be vast. This is why you shouldn’t necessarily have expectations about how the program works if you know what your friends or family members receive from it. It’s critical to remember that their numbers may have nothing to do with yours. Once you know you’ve gotten all you can from it, a financial advisor can tell you more about how to use that income in relation to the rest of your retirement income.

Tax-Free Retirement

If you’re hoping for a tax–free retirement in Colorado Springs, Colo., or Ft. Lauderdale, Fla., you should know there are steps you can take to make it happen. Even when you’re used to paying taxes for what you buy and what you earn, the reality is you likely have more options available to you than you realize. At e Hill Financial Group Inc., with locations in both Colorado and South Florida, you’ll learn more about how to organize your portfolio so you can spend more on the things you care about.

How to Have a Tax–Free Retirement

It’s not always easy to think about taxes. It’s not just the myriad of numbers that all factor into your bottom line either. Every local, state, and federal law plays some role in your paperwork, and it’s not always easy to decipher how those laws help or hurt you. What’s more, you probably don’t know just how many choices you have when it comes down to how you file. It’s not as easy as opening a trust or deferring capital gains on a sale or two.

At a boutique retirement firm, you can work with financial advisors who take the time to go over your taxes. In addition, they’ll look at each decision you make in the context of your larger retirement goals and personal tastes. For instance, if you’re planning on living a fairly modest retirement, you might be planning to use your wealth to help fund your descendant’s future. Or if you pride yourself on your philanthropic efforts, you might want to diversify your charitable giving.

Eugene Hill in Ft. Lauderdale and Eldrick Hill in Colorado Springs understand that taxes can be a minefield to navigate, particularly if you’ve been used to filing them a certain way. The good news is that the right advisor can help you rethink your plans, which can end up strengthening your portfolio.

Long-Term Care

Long–Term Care is a type of insurance policy that will cover costs associated with health care that wouldn’t be covered by a standard health care policy. Because major illnesses and injuries often require a long recovery period, people buy this plan so they can stay above board — particularly during their retirement years when there’s less income streaming in. A financial advisor can tell you more about how this asset would fit in with the rest of your portfolio.

How Does Long–Term Care Insurance Work?

The goal of Long–Term Care insurance is to keep people from falling into a financial trap. Unfortunately, no matter how much a person has saved or otherwise prepared for the worst, it’s not always easy to navigate the costs of at–home care or an extended stay at a nursing home. These plans can be effective, too. One study showed that people with these policies spent about six times less than those who didn’t.

However, this doesn’t automatically mean that everyone should purchase these policies. Due to the costs they cover, which can include a full–time aide at home to help with everything from cooking to hygiene, the policies can be an expensive cost to shoulder. If you’re wondering whether this will be a smart addition to your retirement goals, e Hill Financial Group Inc. is there to help.

With locations in Colorado Springs, Colo., and Ft. Lauderdale, Fla., the advisors can tell you more about who carries this policy and what the various terms and conditions are for each plan. Like all insurance policies, your benefits will be determined by the specific type of plan you get. Some may offer different benefits, such as the ability to recoup some of the costs of the insurance if you never use it. At a boutique retirement firm, you’ll be given the time and information to weigh the pros and cons, based on everything from your family history to your relationship with risk. Whatever questions you have, they can help you navigate the facts.